Warner Bros stock price has been in a strong bull run this year, making it the best-performing company in the Nasdaq 100 Index. It has jumped to $27, up sharply from the year-to-date low of $7.5.

Paramount and Netflix bidding war for Warner Bros

The ongoing WBD stock price surge happened as the bidding war for the company accelerated. After reaching a deal with Netflix on Friday, Paramount Skydance made a superior offer worth $30 per share on Monday.

Paramount believes that it has a superior offer as it also buys its legacy media business. It is also about $17 billion richer than the one made by Netflix. It also believes that the offer has a higher chance of passing the regulatory situation in the US as its business is much smaller than Netflix.

There are three main probabilities going forward. First, Netflix may decide to abandon the deal and pay the separation fee. It may also decide to boost its offer and match that of Paramount.

Second, the alternative scenario is where Paramount takes the offer directly to its shareholders, who will likely approve it as it is a better offer than the one made by Netflix.

The WBD stock price is trading below Paramount’s offer price of $30 because analysts believe that it will take 1.5 years for the deal to complete, and a lot can happen in this period.

Is Warner Bros. Discovery worth $108 billion?

The biggest issue about this deal is on Warner Bros. Discovery valuation, which mirrors the famous $182 billion AOL-Time Warner merger in 2000. This deal also brings back memories of the $85 billion Time Warner buyout by AT&T a few years ago.

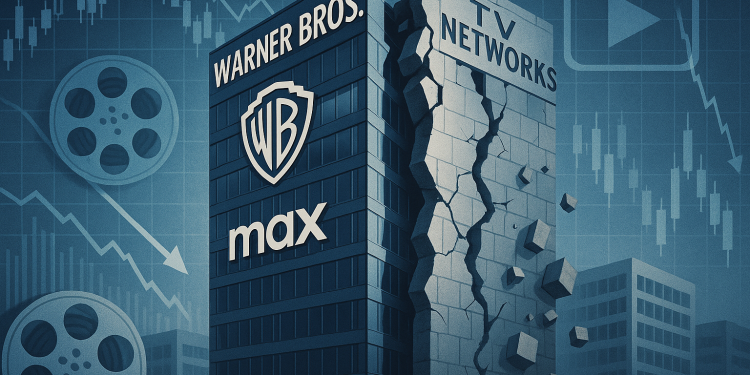

Warner Bros. Discovery is a major media company that owns some of the best-known franchises in the United States, including its studios and HBO. It also owns some traditional toxic assets like CNN, TBS, and Turner Classic Movies.

The main reason why the company makes sense for Netflix is that it would give it one of the biggest studio networks in Hollywood. It would also give it HBO, a service with millions of users. This growth would help it expand its business and create a wide moat.

On the other hand, the deal would help Paramount to grow its business and become a more formidable competitor to Netflix. Paramount also believes that it has more synergies than Netflix.

However, a closer look at Warner Bros numbers shows that the company is not worth the $108 billion that Paramount is paying for it.

The most recent annual results show that it made over $39 billion in annual revenue in 2024, down from $41 billion in the previous year. It has made $37 billion in the trailing twelve months (TTM).

Most importantly, the company is not all that profitable. It made a net loss of over $11.3 billion last year as it wrote down the value ox its networks. The company has never made an annual net profit since its Warner and Discovery merger.

The most recent quarterly results showed that the company’s business is still not doing well to warrant a forward PE ratio of 73. For example, its revenue dropped by 6% in the last quarter, with its distribution, advertising, and content revenues dropping by 4%, 16%, and 3%, respectively. Its net loss during the quarter was $148 million.

Therefore, the most likely scenario is where the potential acquirer will ultimately write down its assets over time as we have seen with companies like Teladoc and Livongo Health, HP and Autonomy, AOL and Time Warner, and AT&T and DirecTV.

The post Why are Paramount and Netflix overpaying for Warner Bros stock? appeared first on Invezz