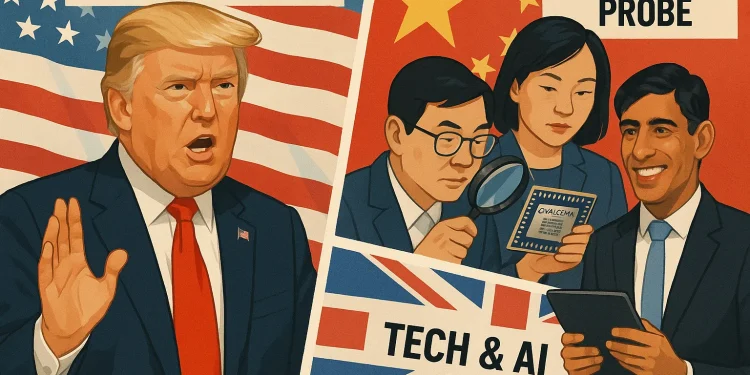

Friday brought fresh developments on the US-China trade front, the federal workforce, and tech regulation.

President Trump threatened steep tariffs on Chinese imports amid rare earth export controls, while federal layoffs began as the government shutdown hit day ten.

Meanwhile, China launched an antitrust probe into Qualcomm, highlighting rising tensions in global tech and trade arenas.

A glance at major developments on Friday.

Trump administration begins federal layoffs

White House budget director Russell Vought announced on Friday that the Trump administration has started laying off federal workers as the government shutdown hits its 10th day.

Vought shared the news on social media, calling the layoffs “reductions in force” (RIFs), but didn’t give many details beyond that.

The cuts are being described as “substantial” and will mainly hit programs considered non-essential or not aligned with the President’s priorities.

Agencies like the Interior, Homeland Security, and Treasury are among those affected.

President Trump has repeatedly said that these layoffs will mostly impact what he calls “Democrat agencies,” and he sees the shutdown as a chance to permanently trim the federal workforce.

Trump threatens massive China tariffs

President Trump is ramping up the trade heat, threatening a “massive increase” in tariffs on Chinese imports after China introduced new export restrictions on rare earth elements, materials that are super important for things like semiconductors and defense technology.

Trump also suggested there’s “no reason” to meet with Chinese President Xi Jinping at the upcoming APEC summit in South Korea, hinting that their planned talks might be off.

He accused China of taking a “hostile” trade approach, trying to corner the market on rare earths that are key for advanced US tech.

The tension comes after China announced tighter controls requiring export licenses for certain rare earth minerals and related technologies, starting in December.

Markets didn’t take the news well, US stock indices dropped amid the uncertainty.

The Trump administration isn’t stopping at tariffs; they’re looking at other measures to counter China financially, signaling a long-term strategy to push back against Beijing’s trade moves.

China probes Qualcomm-Autotalks deal

China has kicked off an antitrust probe into US semiconductor giant Qualcomm over its acquisition of Israeli vehicle chipmaker Autotalks, the country’s State Administration for Market Regulation (SAMR) announced on Friday.

The investigation is looking into whether Qualcomm broke China’s anti-monopoly laws by not properly disclosing details about the deal, which finally closed in June 2025 after being delayed for more than two years.

Following the news, Qualcomm’s stock dipped nearly 3% in premarket trading.

Autotalks makes communication chips designed to boost vehicle safety through vehicle-to-everything (V2X) technology, so the deal is pretty significant for the auto tech space.

This latest move adds another layer to rising economic tensions between China and the US, especially as Chinese regulators are also scrutinizing other American tech companies like Nvidia.

Qualcomm hasn’t commented on the probe yet, which comes just ahead of an important meeting between Presidents Trump and Xi Jinping.

Sunak joins tech and AI leadership

Former UK Prime Minister Rishi Sunak is making a big move into the tech world.

In October 2025, he joined Microsoft and AI startup Anthropic as a senior adviser, stepping into the tech and AI space in a major way.

In these part-time roles, Sunak will give strategic advice on things like macroeconomic trends, geopolitics, and global strategy, though he won’t be dealing with UK-specific policies.

Both appointments got the green light from the UK’s Advisory Committee on Business Appointments (ACOBA), which set rules stopping him from lobbying UK officials or using any insider knowledge from his time in office.

Sunak has said he’ll donate all the money he earns from these roles to The Richmond Project, a charity he co-founded to promote numeracy skills.

This move comes after his return to an advisory role at Goldman Sachs earlier this year.

Technology and AI were key priorities during his premiership; he even hosted the UK’s AI Safety Summit in 2023, so it looks like he’s continuing to have an influence in the sector, now from the private side.

The post Evening digest: Trump begins federal layoffs, Sunak joins AI leadership, new China tariffs ahead appeared first on Invezz