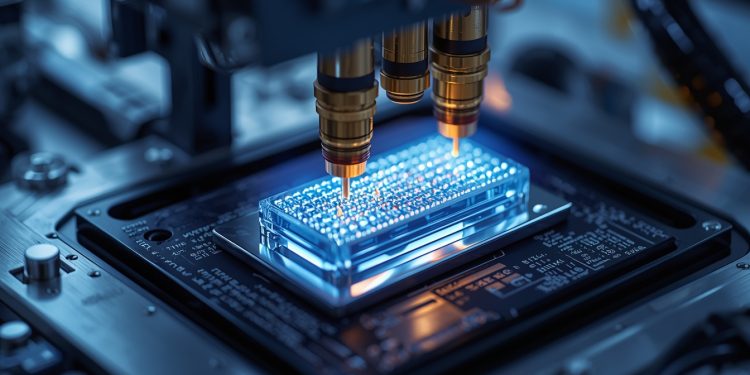

QuantumScape (NASDAQ: QS) shares are electrified today, surging more than 7% in early trading as the company officially inaugurated its much-anticipated “Eagle Line.”

This highly automated pilot production facility in San Jose represents what CEO Dr Siva Sivaram has called the company’s “Kitty Hawk moment” – the point where lab innovation finally translates into a tangible, manufacturable product.

With an earnings report approaching, investor discussion has intensified around the potential for original equipment manufacturer partnerships beyond Volkswagen and the accelerated scale-up of QSE-5 battery cells.

However, despite the recent rebound in sentiment, QuantumScape’s year-to-date performance remains subdued.

The stock is still down more than 15% from its YTD high, underscoring the gap between near-term optimism and longer-term share price trends.

Why QuantumScape’s stock price rally may not be sustainable

The market is currently treating the Eagle Line inauguration as a “mission accomplished”, but the reality is that a pilot line is a far cry from a gigafactory.

While Eagle Line sure proves QuantumScape can automate the assembly of its proprietary ceramic separators using the Cobra process, it doesn’t yet confirm high-yield reliability.

In the world of battery manufacturing, moving from a controlled pilot environment to the chaotic scale of gigawatt-hour production is where most startups meet their “valley of death.”

Investors often overlook the fact that pilot lines are designed for sampling and testing – not for generating the massive volume required to fulfil even a single major OEM’s annual vehicle fleet.

The jump from thousands of cells to millions remains a huge, unproven hurdle – warranting caution in chasing the Eagle Line rally in QS stock.

Licensing lag and partner dependency could hurt QS shares

A significant chunk of QuantumScape’s share price rally is built on the hope of licensing deals, particularly with partners like PowerCo.

While an “asset-light” royalty model sounds attractive on paper, it places the ultimate timeline for revenue entirely in the hands of third parties.

QS isn’t just betting on its own technology – it’s betting also on the construction speed, capex, and operational efficiency of its partners.

If an OEM partner sees a delay in factory construction or decides to pivot back toward improved traditional lithium-ion or sodium-ion chemistries due to cost pressures, QuantumScape’s revenue stream evaporates.

In short, the market’s excitement assumes a frictionless handoff to partners that history suggests is rarely the case in automotive manufacturing.

2027 commercialisation mirage makes QuantumScape less exciting

Finally, the Eagle Line launch has reignited talk of a 2027 commercialisation date, but this timeline may be more optimistic than realistic.

The road from “B-sample” testing – which the Eagle Line will support – to “C-sample” and final production-grade cells usually takes several years of rigorous automotive validation.

Even if the technology is flawless, the sheer length of the automotive design cycle means that meaningful revenue remains a distant prospect.

Investors buying the QS shares’ rally today are likely to face “exhaustion” as the news cycle shifts from the excitement of a ribbon-cutting ceremony back to the grinding reality of quarterly cash burn and technical hurdles.

All in all, without a meaningful revenue surprise in the upcoming earnings, the initial hype surrounding this launch could fade over the next few sessions.

The post QuantumScape stock: why investors are ‘overreacting’ to Eagle Line launch appeared first on Invezz