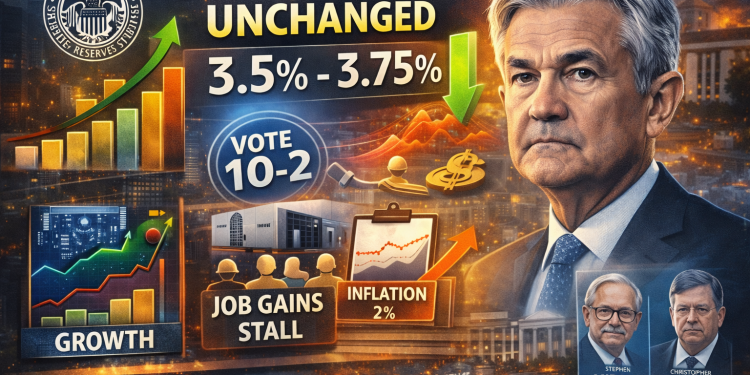

The US Federal Reserve left its benchmark interest rate unchanged at 3.5%–3.75% on Wednesday, effectively putting the brakes on the rate-cutting cycle that defined much of 2025.

The decision reflects a mixed economic picture as growth remains solid, but inflation is proving stubborn, and job gains are losing momentum.

With 10 of the 12 voting members backing the move, the signal from policymakers is hard to miss; further rate cuts are unlikely in the near term.

US Fed meeting 2026: The inflation question

Powell and his colleagues are walking a tightrope.

The economy is still expanding at a solid clip, but inflation remains “somewhat elevated,” the Fed’s carefully chosen way of saying the problem isn’t solved yet.

Price pressures are still running above the central bank’s 2% target, raising the risk that moving too quickly on rate cuts could undo hard-won progress.

That helps explain why policymakers chose to pause in January.

After delivering three straight quarter-point cuts in September, October, and December, the Fed decided it was time to step back and take stock rather than push ahead.

Markets have taken note. Expectations now center on just a single rate cut in 2026, likely around mid-year, and even that is far from assured.

Against that backdrop, it’s telling that the two dissenting votes came from Stephen Miran and Christopher Waller, not because they opposed easing, but because they wanted to cut rates immediately.

Their stance highlights the growing divide inside the Fed.

Some officials are increasingly uneasy about a cooling labor market and argue for a faster response, while others remain comfortable holding the line and waiting for clearer signals.

Job gains have stalled

Here’s the problem the Fed won’t ignore: job gains have “remained low,” and unemployment has stabilized rather than improved.

In normal times, this would scream for rate cuts to stimulate hiring. But the Fed isn’t in a normal situation.

The economy is still growing fast; third-quarter growth hit 4.4%, nearly double the long-term trend.

That kind of strength suggests the labor market’s slowdown isn’t a crisis, just a normalization after years of outsized gains. The Fed is betting it can leave rates alone and let this play out.

The wait-and-see game

The statement left the door open for future moves, either cuts or hikes, depending on what the data shows.

This language matters. It tells markets the Fed won’t be locked into any preset path. If inflation cools faster than expected, cuts could come earlier.

If the labor market deteriorates sharply, the Fed would act. If new risks emerge, they’re prepared to adjust.

For borrowers hoping for relief, the message is sobering: rates are likely staying here for a while. This is headwind for mortgage seekers and anyone carrying variable-rate debt.

But for savers and investors in money market funds, higher for longer means continued yield opportunities.

Powell under pressure

This decision lands in an unusual political climate.

The Fed has faced subpoenas from the Justice Department, sparking concerns about central bank independence.

Powell, in a rare personal statement, made clear the Fed’s decisions are based on economic evidence, not political preferences.

Wednesday’s hold, maintaining rates despite calls from the White House for cuts, reinforces that independence.

Whether that holds remains an open question as the administration signals plans for a new Fed chair in Powell’s final months.

The Fed is hitting pause on its easing campaign, choosing caution over aggression.

Solid growth, stubbornly high inflation, and labor market softness have created a puzzle with no perfect answer.

The post US Fed holds rates at 3.5%-3.75% as inflation stays elevated and job gains cool appeared first on Invezz