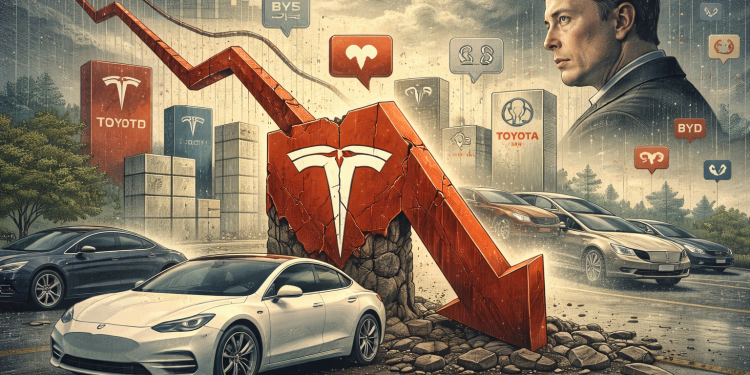

Tesla’s brand value fell sharply in 2025, extending a decline that has now run for three consecutive years, according to a new report from Brand Finance.

The electric vehicle maker lost an estimated $15.4 billion in brand value last year, a drop of about 36%, reflecting weakening consumer sentiment despite the company’s continued prominence in global markets.

Brand Finance said Tesla’s brand value now stands at $27.61 billion in its 2026 rankings, down from $43 billion at the start of 2025.

The figure marks a steep fall from the company’s peak valuation of $66.2 billion in early 2023.

Brand Finance, which is based in London, assesses brand value by combining financial performance indicators such as revenues and margins with consumer perception data gathered through extensive surveys across multiple markets.

Innovation gap and Musk’s political gambits dent brand value

David Haigh, chief executive of Brand Finance, said Tesla’s declining brand strength was driven by several factors, including a lack of high-profile new vehicle launches and pricing that remains relatively high compared with a growing field of competitors.

He also pointed to chief executive Elon Musk’s increasing involvement in geopolitics and public policy debates, arguing that this has distracted attention from Tesla’s core automotive business and undermined confidence among consumers.

On measures such as reputation, trust and recommendation, Tesla’s scores deteriorated markedly over the past year, according to Lorenzo Coruzzi, valuation director at Brand Finance.

The declines were most pronounced in Europe and Canada, regions where competition in the electric vehicle market has intensified.

In the United States, Tesla’s recommendation score fell to a new low of 4 out of 10, indicating a reluctance among consumers to recommend the brand to friends or family.

That compares with a score of more than 8 recorded in 2023.

Survey responses from at least a 1,000 people in each of 18 countries were used to assess public attitudes toward the brand.

Customer loyalty in the US improves

Not all indicators moved in the same direction.

Brand Finance said general familiarity with Tesla improved across most markets, reflecting the company’s maturity and expanding geographic reach.

Customer loyalty also edged higher in the United States, with the share of Tesla owners saying they intended to continue driving the brand over the next year rising to 92% from 90%.

That suggests existing customers remain committed, even as broader public sentiment has softened.

However, Brand Finance said loyalty alone was not enough to offset the damage from falling trust and recommendation scores, which are seen as critical for attracting new buyers.

Rivals gain ground as Tesla slips down rankings

While Tesla’s brand weakened, several rivals strengthened their positions.

China’s BYD emerged as one of the biggest winners in the automotive sector, with its brand value rising by about 23% to $17.29 billion.

The company has benefited from aggressive pricing, rapid product launches and strong growth in both domestic and overseas markets.

Five automakers ranked above Tesla in the latest list, including Toyota, Mercedes Benz, Volkswagen and Porsche.

Toyota remained the strongest automotive brand globally, with an estimated value of $62.7 billion.

Brand Finance said the divergence highlighted a growing gap between Tesla’s standing with consumers and its valuation in financial markets.

Politics, policy and a volatile year for shares

Tesla’s brand challenges unfolded during a turbulent year for its stock.

Shares began 2025 on a strong note after Musk joined President Donald Trump’s administration to lead a government efficiency drive.

However, Musk’s political activity, including endorsements of far right figures in Europe and Britain, triggered a consumer backlash that lingered through the year.

The removal of a federal tax credit for electric vehicle purchases in the United States added to the pressure.

Tesla’s shares later recovered, helped by the launch of a ride hailing app, early robotaxi trials in Texas and a large personal share purchase by Musk.

By the end of the year, the stock had gained about 11%.

The post Tesla loses $15.4B in brand value in 2025, marking third straight annual decline appeared first on Invezz