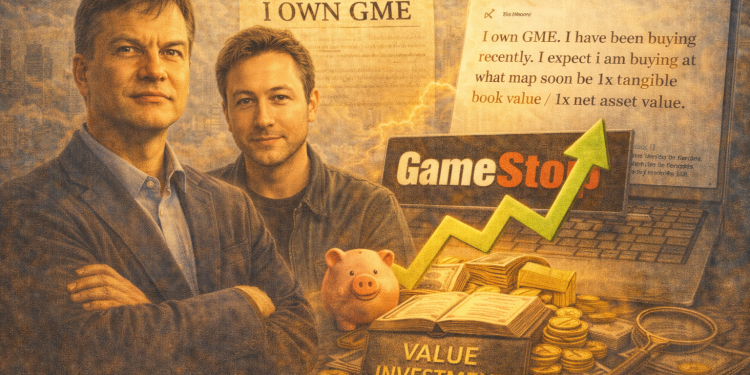

Michael Burry, the investor best known for profiting from his bet against the US housing market ahead of the 2008 financial crisis, said he has been buying shares of GameStop.

He described the position as a long-term value investment rather than a renewed play on meme-stock volatility.

In a Substack post published Monday, Burry said he expects his purchases to be near a valuation that reflects the company’s underlying assets rather than speculative enthusiasm.

“I own GME. I have been buying recently. I expect I am buying at what may soon be 1x tangible book value / 1x net asset value,” Burry wrote.

“And getting a young [GameStop CEO] Ryan Cohen investing and deploying the company’s capital and cash flows. Perhaps for the next 50 years.”

Shares of GameStop rose nearly 8% on Monday following the disclosure, reflecting renewed investor interest after Burry’s comments became public.

Burry frames GameStop as a value play

Burry, who recently shut down his hedge fund Scion Asset Management, said his thesis does not rely on a resurgence of meme-stock dynamics or a short squeeze.

GameStop was at the centre of a historic retail trading frenzy roughly five years ago, when coordinated buying by individual investors drove the stock to extreme levels and forced hedge funds with short positions to cover.

“I am not counting on a short squeeze to realise long-term value,” Burry wrote.

“I believe in Ryan, I like the setup, the governance, the strategy as I see it. I am willing to hold long-term, and I am excited to see where this goes. I am fifteen years his senior, but not too old to be patient.”

Since the height of the meme-stock episode, GameStop shares have surrendered most of their gains as trading activity normalised and speculative interest faded. The stock was last trading around $25.

Despite the decline, GameStop has taken advantage of periods of elevated investor enthusiasm to raise billions of dollars through equity offerings, significantly strengthening its balance sheet.

“Ryan is making lemonade out of lemons,” Burry wrote. “He has a crappy business, and he is milking it best he can while taking advantage of the meme stock phenomenon to raise cash and wait for an opportunity to make a big buy of a real growing cash cow business.”

Ryan Cohen deepens his own commitment

Burry’s comments come as GameStop’s chief executive has also increased his personal stake in the company.

According to a Schedule 13D filing, Cohen purchased 500,000 shares last Tuesday at an average price of about $21.12 per share.

He followed up on Wednesday with an additional purchase of 500,000 shares at roughly $21.60 each.

The transactions totalled approximately $21.4 million. After the purchases, Cohen owned more than 42 million shares, representing a 9.3% stake in GameStop.

In the filing, Cohen said it was “essential” for chief executives of public companies to buy shares with their own money “in order to further strengthen alignment with stockholders.”

Cohen became GameStop’s chairman in 2021 after building an activist stake in the company in 2020 and assumed the chief executive role in 2023.

The post GameStop stock rockets 8% as Burry reveals stake, calls investment long-term bet appeared first on Invezz