Rolls-Royce share price has held steady in the past few days, moving from a low of 1,020p on November 24 to the current 1,110p. It has jumped by over 100% from its lowest level in January and is a few points below the year-to-date high of 1,195p. So, is it still safe to buy the RR stock?

Rolls-Royce share price has lost momentum

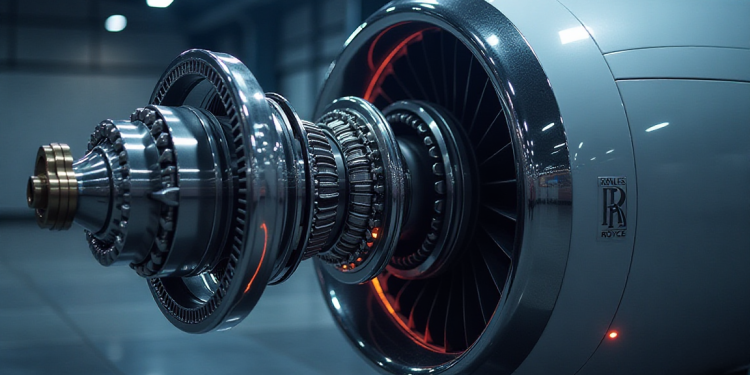

Rolls-Royce, the giant British engine manufacturer, has been one of the best-performing companies in the FTSE 100 Index this year, helped by the robust demand of its products across its verticals like civil aviation, defense, and energy.

The company has emerged from being one of the top laggards during the pandemic into the best performer, with its stock soaring from a low of 62.15p in 2022 to the current 1,112p, a 1,527% surge that pushed its market capitalization to over $126 billion. It has become one of the biggest British companies.

The company has emerged from being a “burning platform” as the CEO described it into being a highly profitable enterprise. In a recent trading statement, the management reaffirmed its forward guidance in terms of profitability and cash flow.

It now expects its full-year operating profit to be between £3.1 billion and £3.2 billion, with its free cash flow being between £3.0 billion and £3.1 billion.

This growth happened as the company received large orders from companies like IndiGo and Malaysia Airlines, and after the active flying hours crossed the pre-pandemic levels.

READ MORE: Rolls-Royce share price forecast for December: will it rebound?

Rolls-Royce Holdings’ business has also benefited from the ongoing boom in the defense industry. For example, the German parliament will soon vote on a 50 billion spending package that will mostly benefit European defense contractors.

Meanwhile, the RR stock price has done well because of its Small Modular Reactors (SMR) business. This business has already received a large order from the United Kingdom government. Talks are underway with other countries.

The company is also aiming to expand its SMR business to the United States, where the Trump administration recently announced a $800 million deal to invest in the sector. This program will benefit states like Tennessee and Michigan.

Rolls-Royce is one of the top players in the nuclear energy industry, an area it has been in since the 1950s. As such, the company may ultimately become a formidable competitor to companies like Oklo and NuScale, which have become multi-billion-dollar entities.

Despite its strong stock performance, the company is still not all that expensive as it has a trailing P/E ratio of 16.9, much lower than the S&P 500 Index average of 22.

Rolls-Royce stock price technical analysis

The daily timeframe chart shows that the RR stock price has remained in an upbeat tone in the past few days. It jumped from a low of 1,020p in November to the current 1,112p.

The stock has moved above the 50-day and 100-day Exponential Moving Averages (EMA). This is a sign that bulls remain in control today.

Rolls Royce share price has also formed a megaphone pattern and a bullish flag. A bullish flag is one of the most common continuation signs in technical analysis.

Therefore, the most likely scenario is where the stock continues rising, with the next key target to watch being at 1,195p, its highest point this year.

The post Rolls-Royce share price eyes a rebound as a bullish pattern forms appeared first on Invezz